Dubai property: Government initiatives to boost demand in 2020

Major steps by the government and an increased number of pro-growth initiatives over the past year are expected to boost sentiment and drive demand in the UAE’s real estate market in 2020, according to the latest report from consultancy JLL.

The firm's annual review of the UAE real estate market found that although residential rents and sale prices continued to decline, it expects a flattening of both over the next 12 months.

Apartment rents and sales prices in Dubai declined 8 per cent and 5 per cent respectively in 2019 compared to the previous year. Similarly, villa rent and sale prices fell by around 8 per cent and 10 per cent respectively.

In 2019, more than 35,000 residential units were handed over in Dubai, which is the highest ever delivered in a year, while 83,000 units are scheduled to be delivered in 2020 (although it expects actual handovers to be far lower). Major projects scheduled for delivery in 2020 include the Azizi Riviera project in Meydan and Al Habtoor City.

In preparation for Expo 2020, residential supply is expected to reach 638,000 by the end of 2020, representing an average annual increase of 15 per cent.

“Overall the residential market remains tenant-friendly, with landlords offering flexible payment options in order to attract new tenants," the report said.

“In addition to the various initiatives launched by the government to boost residential demand from potential foreign investors and residents, developers are also trying to enhance the residential market by providing various initiatives such as waiving off the 4 per cent registration fees, offering monthly payment schemes, and post-handover plans.”

The Dubai government has taken steps to also limit future supply, with the formation of a new Real Estate Planning Committee in the third quarter of 2019. Developers are also launching fewer new projects and focusing on the sale of existing inventories.

For Abu Dhabi, apartment rents declined 6 per cent year-on-year in quality masterplanned communities and villa rents fell 4 per cent in prominent developments. Sale prices for prime villas remained stable, whereas prices for apartments recorded a 9 per cent drop. A further decline in rents and sale prices is expected this year, the report said, due in part to an expected supply increase.

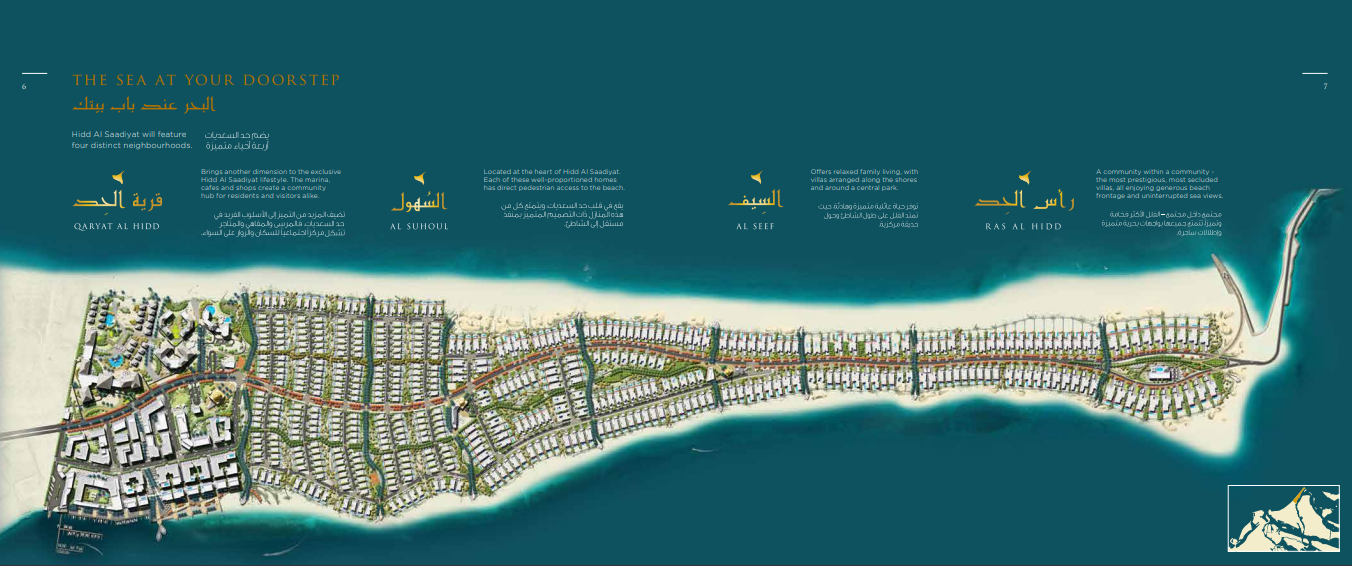

Around 1,000 residential units were delivered in the fourth quarter of 2019, bringing the total stock to approximately 261,330 units. By end of 2020, a further 11,400 units are scheduled to enter the market, mainly within masterplanned communities such as Al Reem Island, Al Raha Beach, Saadiyat Island, and phase one of Riyadh City, it said.

In the hospitality sector, demand is expected to recover considerably with various government initiatives set to take effect this year, and the expected strong visitor growth associated with Dubai's Expo 2020. Other popular events such as the annual Formula 1 Etihad Airways Abu Dhabi Grand Prix in Abu Dhabi will also continue to attract international visitors to the UAE.

Last year saw the introduction of several government initiatives to boost the hospitality sector, such as the exemption of the visa fee for transit passengers and a focus on increasing the popularity of Dubai in the cruise industry, among others.

“Large-scale projects, new visa rules and Expo 2020 Dubai will boost tourist arrivals in the coming months,” said Dana Salbak, head of research Mena at JLL.

“Around 25 million visitors are expected in Dubai from 192 countries during Expo 2020 Dubai alone. These factors have ensured the hotel market, specifically, will maintain healthy performance levels, continuing the UAE’s status as a major global tourist and business destination. That said, in the year ahead, market performance will also heavily depend on how quickly some of the newly-announced initiatives take effect.”

In Dubai, around 7,200 hotel rooms were added in 2019, out of which around 3,200 were added in the last quarter.

Hotel supply is expected to reach around 151,000 keys by the end of 2020, with notable projects including Artesia in Damac Hills and Royal Atlantis in Palm Jumeirah.

Meanwhile, the office market remained in favour of tenants for all of 2019 and the trend is expected to continue in the year ahead as well. In Dubai, Grade A rents in the central business district dropped by 13 per cent to Dh1,358 per square metre per year in the final quarter and average vacancy rates increased by 3 per cent to 14 per cent. In Abu Dhabi, office rents dropped by about 5 per cent to Dh1,600 per sq m per year and vacancy rates increased by 4 per cent to 28 per cent.