Aldar Properties Q4 net profit surges 81% on higher revenue and improving environment

Aldar Properties, Abu Dhabi's biggest listed developer, reported an 81 per cent surge in fourth quarter net profit as the company's revenue increased in the last three months of 2019.

Net profit attributable to shareholders for the period ending December 31, climbed to Dh577 million, the company said in a filing to the Abu Dhabi Securities Exchange, where its shares trade. Quarterly revenue jumped 17 per cent to Dh2.1 billion.

"Abu Dhabi’s real estate market is benefitting from an economy that is transitioning to a global cultural, business and trade hub thanks to government investments and newly introduced pro-business policies," said Mohamed Al Mubarak, chairman of Aldar. "Looking ahead, our unique portfolio of investment properties and valuable land bank will enable us to continue to deliver attractive returns to our shareholders."

Net profit for the full-year rose 7 per cent to Dh1.98bn as revenue climbed 14 per cent to Dh7.1bn. The profit was above estimates of analysts polled by Bloomberg.

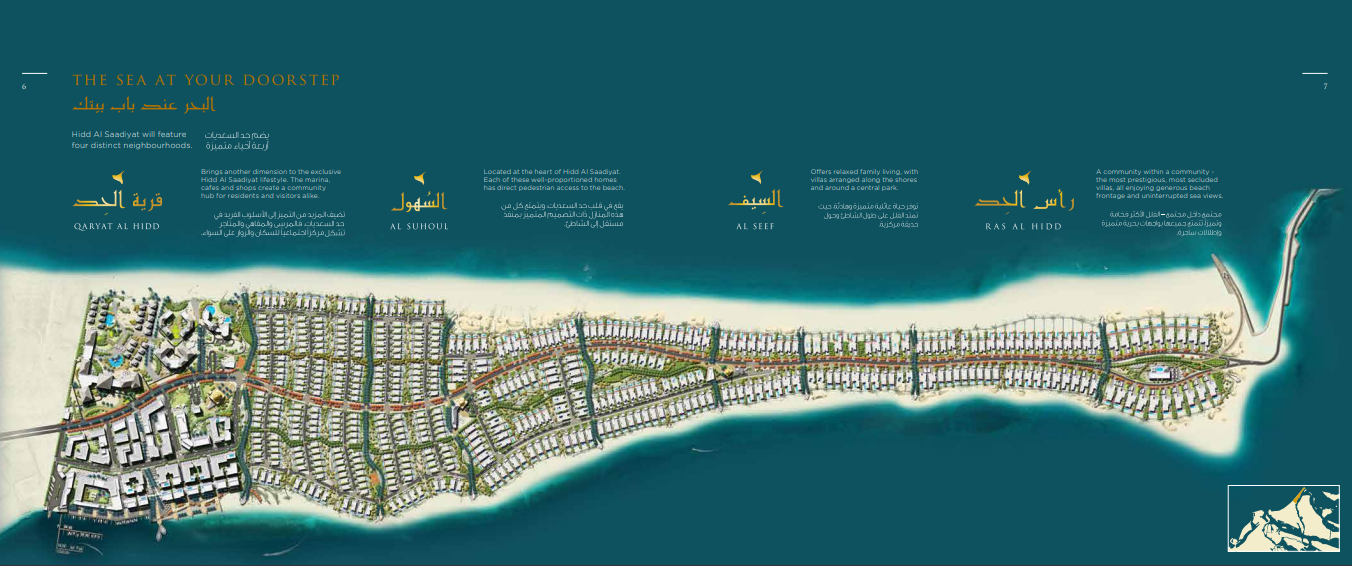

Development sales increased 53 per cent to Dh4bn in 2019, driven by new launches including Alreeman, Alreeman II, Lea and Saadiyat Reserve, as well as strong sales across existing developments comprising Yas Acres, Wes Yas and Mamsha.

Backlog of development revenue to be recognised in the future grew to Dh4.4bn at the end of 2019, Aldar said.

Last year, hospitality gross profit rose 30 per cent and revenue per average room climbed 8 per cent, driven by a strong event calendar in Abu Dhabi and promotion of tourism and leisure sector.

The company’s board recommended a cash dividend of Dh0.14 per share, 4 per cent higher than 2018 dividend.

"As the Abu Dhabi government’s fiscal growth programmes take effect, we are seeing clear signs of growth in key segments of the real estate market," said Talal Al Dhiyebi, chief executive of Aldar.

The company has registered a 53 per cent increase in development sales, a 30 per cent increase in hospitality profit and an 80 per cent rise in profit from Aldar Education.

"We remain confident in our platform’s ability to grow and deliver sustainable returns to our shareholders," Mr Al Dhiyebi said.

Aldar expects development sales of Dh4bn achieved in 2019 to continue this year, as the company expects to achieve strong sales in 2020. Aldar's chief financial officer, Greg Fewer, said in a media conference call.

"We had the strongest year ever in off plan sales of Dh4bn and we think that is going to continue in 2020. There is a positive sentiment in the market," Mr Fewer said.

"We’ve got a fair bit of quality inventory from our large portfolio of projects that is also available to sell to the market."

Aldar also expects its net operating income from asset management business to rise this year, climbing to Dh1.8bn in 2020 from Dh1.7bn last year, Mr Fewer said.

The real estate market in the capital is benefitting from favourable supply and demand dynamics, helped by government initiatives to support the emirate's economy.

The economic reforms and fiscal measures include Ghadan 21, a Dh50bn three-year stimulus package, and new legislation introduced last year that allows freehold ownership of properties in Abu Dhabi.

Changes to the federal visa regulations, including the introduction of a golden class of long-term residency permits and new business licences are also expected to support growth in Abu Dhabi's property market.

Aldar and the Abu Dhabi government in 2019 also agreed to swap land ownership in key locations. As part of the transaction, Aldar will receive infrastructure-enabled plots with a gross area of approximately 3 million square metres. The parcels of land are split equally between the prime areas of Saadiyat Cultural District and Mina Zayed, the company said in a bourse filing at the time.

The Abu Dhabi government, in turn, will get lands with a comparable area in Al Raha Beach West and Lulu Island, along with certain plots inside the main island.